Hi there,

Here’s one I hear a lot from people who want to buy franchises:

“I want a big name franchise that’s been around for years. They must be doing something right!”

Now, I wrote last week about how much brand recognition is actually worth. But there are other problems.

When legacy becomes baggage

Wendy's just announced they're closing 300 stores, about 5% of their system.

Their explanation? Many of their 55-year-old chain's restaurants are "out of date."

Think about that for a second. What was the world like 55 years ago?

1971. Nixon was president. The U.S. was still a manufacturing economy. Small towns were thriving because that's where the jobs were.

Since then, we've seen the entire urbanization of this country. The manufacturing core eroded and we became a technical economy. That changes where consumers live and how they behave.

So it’s no surprise that Wendy's has decades-old restaurants in markets that can no longer sustain them. A lot of these, it’s not even worth renovating.

So you end up with outdated locations losing money, dragging down the brand's image.

Walking into a Wendy's today is like walking into a T-Mobile store: sleek, modern, totally different from what I remember.

But that transformation isn't happening everywhere.

And those legacy locations are just baggage.

In short: "Legacy" doesn't automatically mean "stable." Sometimes it just means "old problems."

The Consolidation Trap

Here's another issue with legacy brands that most people don't think about until it's too late:

They're already consolidated.

I work with a lot of people who want to get into franchising to grow through acquisition. Build an empire. Roll up units over time.

It’s a great strategy that I’ve written about before.

But it doesn’t work in every system. Because in the big brands, your competition might have been running that playbook for decades already:

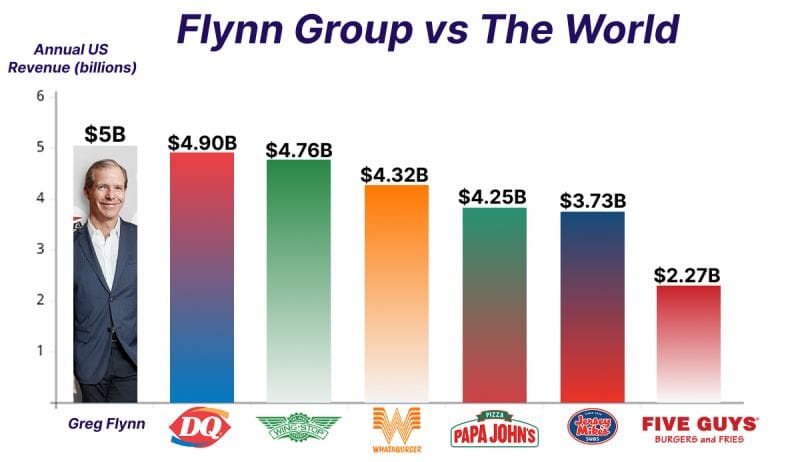

Want to compete in Applebee’s? Flynn Group owns over 450 of them, in 23 states. (29% of the whole brand.)

Pizza Hut? Arby’s? Wendy’s? Flynn Group. You get the picture.

It’s not just Flynn Group, for the record. Tons of systems have big players. And the older the system, the more likely it is to have a dominant group that snaps up every good opportunity they can.

So if you’re hoping to buy a bunch of franchises…

Look at smaller, younger systems, where you’re not showing up for a pickup game against LeBron James.

So when does legacy make sense?

Context matters.

If you're just going to own and operate one unit, you don't have the same considerations as someone whose goal is to build a portfolio.

Legacy brands can work when:

You want a single location with a proven playbook

The brand has genuine positive equity in your specific market

You're not trying to grow through acquisition

But if your goal is to build something bigger, be very cautious.

You're looking for some degree of scale (to validate the model works), but not so much that you're already behind the eight ball against the competition.

The bottom line

Don't confuse "big name" with "better opportunity."

Brand recognition cuts both ways. Legacy can mean baggage. And the biggest franchises are often the most consolidated, which limits your upside if you're trying to grow.

The right question isn't "which brand do people recognize?"

It's "which brand fits my goals?"

If you want help figuring that out, let's talk.

Connor

P.S. I help people find the right franchise fit every day. If you're serious about exploring your options, book a free strategy call here. No strings attached.

How did you like today's issue?

Ready for the next step? Here are 3 ways I can help you:

BEGINNER? Read my quickstart guide — 5 Steps to Finding the Right Franchise (subscribe & refresh this page to access)

GETTING SERIOUS? Go deeper with my complete franchise-finding process (subscribe & refresh this page to access)

IT’S GO TIME. Book a call and let’s get started.